A new study shows increases in the average level of student loan debt for 2011 graduates across the U.S.

Average student debt climbed to $26,600 for 2011 grads according to the study, up 5% from the previous year, an increase that is in line with the hike in prior years.

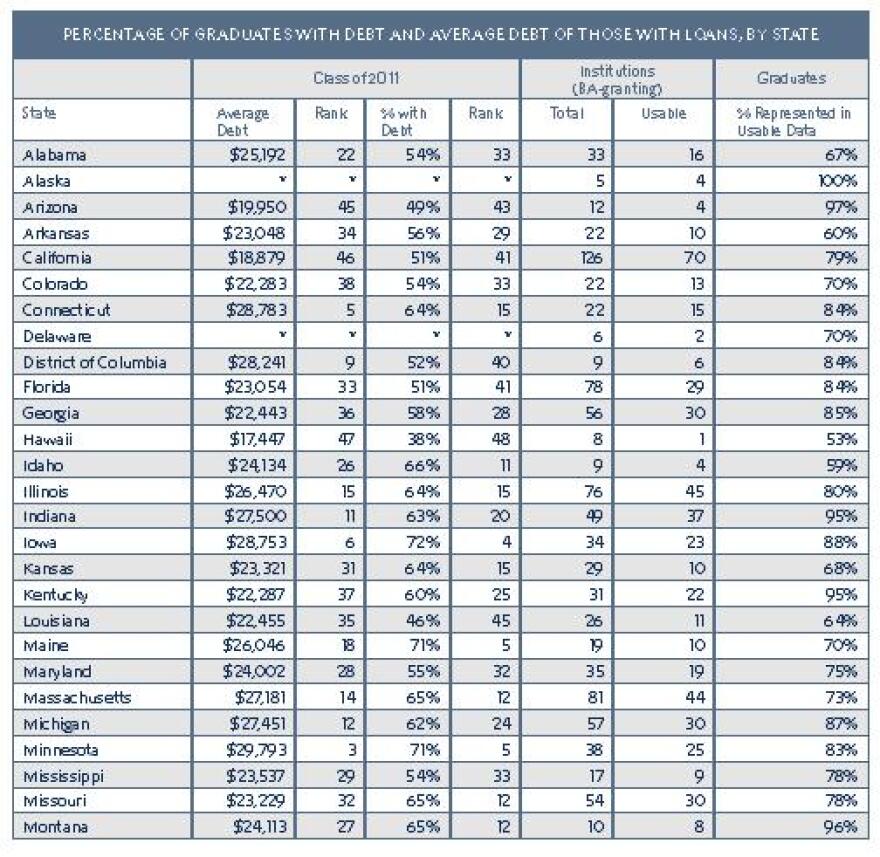

The study by the Institute for College Access and Success shows there is a wide variation in the amount of student loans around the nation, but also within states.

Nationally, two thirds of students graduate with loans ranging from $3,000 to more than $50,000.

Debbie Cochrane from the Institute says New York state has a high disparity of its own.

“There’s a real difference between the public college graduates in New York, and the private non-profit graduates in New York, in that public college graduates tend to have about $20-21,000 in student loan debt, whereas students graduating from the non-profits have about $30,000”

State rankings:

New York state is ranked 19th in the country with the average student debt at graduation sitting at $25,851. It is ranked 25th in the country for the percentage of students graduating with debt with 60% of grads carrying loans.

The study says on top of graduating with debt, recent college graduates are heading into a very difficult job market.

“The unemployment rate for young 2011 college graduates remained high at 8.8%... in addition, many more young graduates were considered underemployed. Among those who wanted to be working fulltime, as many as 19.1 percent were either working part time or had given up looking for work. Further, 37.8 percent of working young graduates had jobs that did not require a college degree, depressing their wages.”

However, Cochrane says it is better to graduate with debt than not at all.

“Student loans are one of the greatest investments someone can make in their future. People who graduate with Bachelor’s degrees have higher wages and higher employment rates than students who didn’t take out the loans to get the bachelor’s degree. Much better to get the Bachelor’s degree, even if it means incurring some debt, than to not take out the loans and not get the degree.”

The study says the unemployment rate for young high school graduates was more than double the rate for young college graduates in 2011.

Among the key recommendations in the study is that the federal government should provide students and families with key information to make sound decisions. It says the average debt at graduation at all colleges that receive federal funding should be available.

The report says that high-debt states remain concentrated in the Northeast and Midwest, while low debt states are mainly in the West and the South.